You are leaving the nbkc bank website and will be linked to an external website

You are about to link to an external website. nbkc bank is not responsible for the availability of content and does not represent either the linked website or you, should you enter into a transaction. We encourage you to review the privacy and security policies for any hyperlinked site which may differ from nbkc bank.

Here’s how we service your business.

Running a business is hard work. That’s why we make our business services

easy to understand and even easier to use.

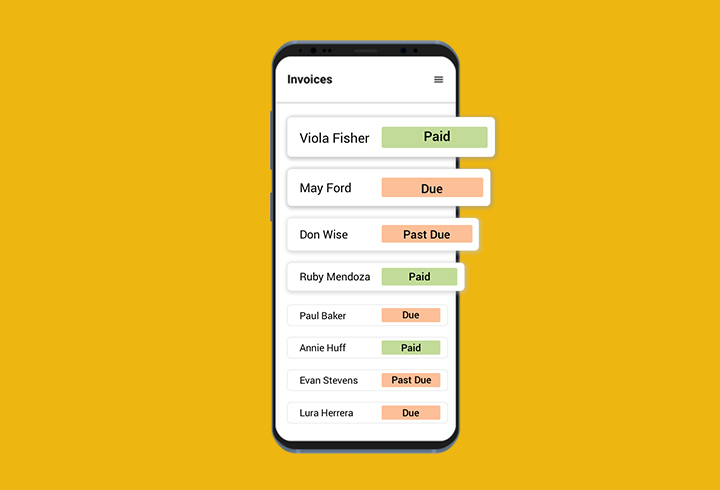

Tap to Pay on iPhone

With your nbkc mobile app and Tap to Pay on iPhone, you can get paid right on your phone.

Autobooks

The nbkc difference

The Perfect Size Bank

Our bank is the perfect size to make your lending experience as good as it gets. We’re large enough to help you finance multiple projects, and small enough to know your name.

One-on-One Service

You’ll get one-on-one personalized service from our expert loan officers who are ready to execute on time and according to plan, and understand the local Kansas City market.

Funds are Quick & Safe

We manage all your documents online and process them in-house so you can get your funds as quickly and safely as possible. No cracks to slip through here.

Would you like the tour?

It’s good to have easy, online banking services. But it’s even better to have real people helping you along the way. Especially when we’re the real people helping you along the way.

Rates change. Reviews are forever.

“We switched to nbkc after banking with the same bank for 15 years. The whole process of not only switching personal but also my small business to a new bank was a bit overwhelming to say the least. But everyone at nbkc made the process much easier. I am so thankful!”