You are leaving the nbkc bank website and will be linked to an external website

You are about to link to an external website. nbkc bank is not responsible for the availability of content and does not represent either the linked website or you, should you enter into a transaction. We encourage you to review the privacy and security policies for any hyperlinked site which may differ from nbkc bank.

Why the nbkc HELOC is worth writing home about.

A line of credit lickety split.

On average, your funds will be available within 14 days.

Your nbkc appraisal still applies.

Use a previous nbkc home appraisal within 6 months for your nbkc HELOC appraisal.

How does a HELOC work?

A home equity line of credit (HELOC) borrows against the equity you have built up in your home. It’s a revolving line of credit meaning you draw from it as you need it throughout a draw period that typically lasts several years.

What you could do with a HELOC.

- Kitchen renovation

- Bathroom remodel

- New roof

- Energy-efficient windows

- An in-ground pool

- Solar panels

- Start that business, finally

- Consolidate debt

- An alternative to student loans

- Large or ongoing medical bills

- Buy a rental property for passive income

- Raise the limit of your emergency fund

Why the nbkc HELOC is worth writing home about.

HELOC

5.99%

APR1 intro rate

7.75%

APR1 thereafter rate

Average

Credit Card

27.91%

APR2

We’re Kansas City-proud, with satisfying services and satisfied customers nationwide.

Home Equity Line of Credit Calculator

You may be sitting on more cash than you realize. Let’s estimate what you’re working with — no strings attached.

* Important information about our HELOC calculator:

Final home value to be determined by nbkc bank appraisal. The sample information provided in this calculator is for informational, educational, and entertainment purposes. Hypothetical illustrations do not guarantee historical or future results. It is the responsibility of the borrower to evaluate loan offers and associated risks or rewards of each product.

What about a Closed-End Second Mortgage?

Questions we get asked, frequently.

Calculate your monthly payment with our HELOC calculator.

At nbkc, there is an early termination fee of $500 if the HELOC is closed within 36 months.

The amount you can access with a Home Equity Line of Credit (HELOC) depends on several factors, including:

- Your home’s value

- Your remaining mortgage balance

- Your lender’s loan-to-value (LTV) limit*

- Your credit score and income

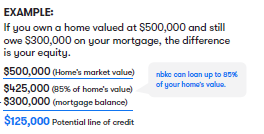

*Typically the Loan To Value (LTV) ratio shouldn’t exceed 85% of the fair market value of your home. However, the exact amount will depend on how much money you may still owe on your home. Below is an example of how to calculate the approximate amount of your line of credit.

Access to your Home Equity Line of Credit (HELOC) funds depends on whether you're opening a new HELOC or accessing an existing one. For a new HELOC, nbkc bank makes funds available on average within 14 working days after the application process begins. Following the loan closing, there's typically a three-business-day rescission period (for primary residences), during which you can cancel the loan. After this period, funds are usually accessible.

nbkc’s Home Equity Line of Credit does not have a minimum draw or initial draw requirement.

Nope. It’s a revolving line of credit taken out against the equity you’ve built in your home. We do offer Closed-End Second Mortgages if that’s something you’re interested in.

A CES loan taps into your home equity without touching the rate on your first mortgage.

This is different from a HELOC in that you:

- Receive the entire loan amount in one lump sum

- Cannot withdraw any more cash after you receive the lump-sum loan

If you’d rather apply for that, apply here.

We review all credit applications. Here are some general guidelines to keep in mind for the best chance of qualifying:

- You’re more likely to be approved for a HELOC if your loan-to-value (LTV) ratio is lower. This means the amount you're borrowing is smaller compared to your home's appraised value. Ideally, we’re looking for an LTV below 85%.

- You'll need to have at least $25,000 worth of equity in your home.

- Applicants must live in one of the 50 U.S. states.

- A good or great credit score can help improve your chances of approval.

- If you live in a single-family home that you own and occupy, your application is more likely to be approved. Larger properties (like those over 5 acres) or tiny homes may not qualify as easily.

Yes, it does. Which is why it’s important not to overextend yourself when figuring out your payments.

Yes. If you were to do it, we’d recommend doing it before the draw period ends.

There are two periods of time for a HELOC.

The Draw Period - the time you can borrow up to your credit limit and make minimum interest payments. Typically 10 years, but could be shorter.

The Repayment Period - the time after the draw when you need to repay the remaining balance. Typically 10 to 20 years.

Now it’s time for us to ask you a question.

Are you ready to learn how you could access cash your house is sitting on?

1APR = Annual Percentage Rate. Offer is not available in the state of Texas or in Puerto Rico, Guam, US Virgin Islands, American Samoa, or Commonwealth of the Northern Mariana Islands. Loan approval and loan amount is subject to underwriting, credit qualifications and bank-determined property value through a desktop appraisal. Property ownership and property type restrictions may apply. nbkc bank does not offer HELOCs for second residences. Rates and offer may change or be discontinued at any time and without notice. Rates are based on the Prime Rate published in the Wall Street Journal plus margin but will never exceed 18% APR. Rates as of 12/17/2025. Consult a tax advisor regarding the deductibility of interest. nbkc bank customers are eligible for bank-paid third-party fees up to $1,000. Borrowers must pay all third-party fees exceeding $1,000 at closing. If a HELOC is modified or refinanced, the borrower does not qualify for bank-paid fees or the introductory rate. The introductory rate is given once per the life of loan on a residence. Minimum loan amount of $25,000.

2Federal Reserve as reported by Forbes , as of September 2024